CloudQuant Allocations

td753764

Posts: 67

td753764

Posts: 67

Hi Everyone,

If you aren't following us on Twitter, LinkedIn, or Facebook you might not have seen recent news on our allocations. We keep a record of all allocations to trading strategies on our main web page.

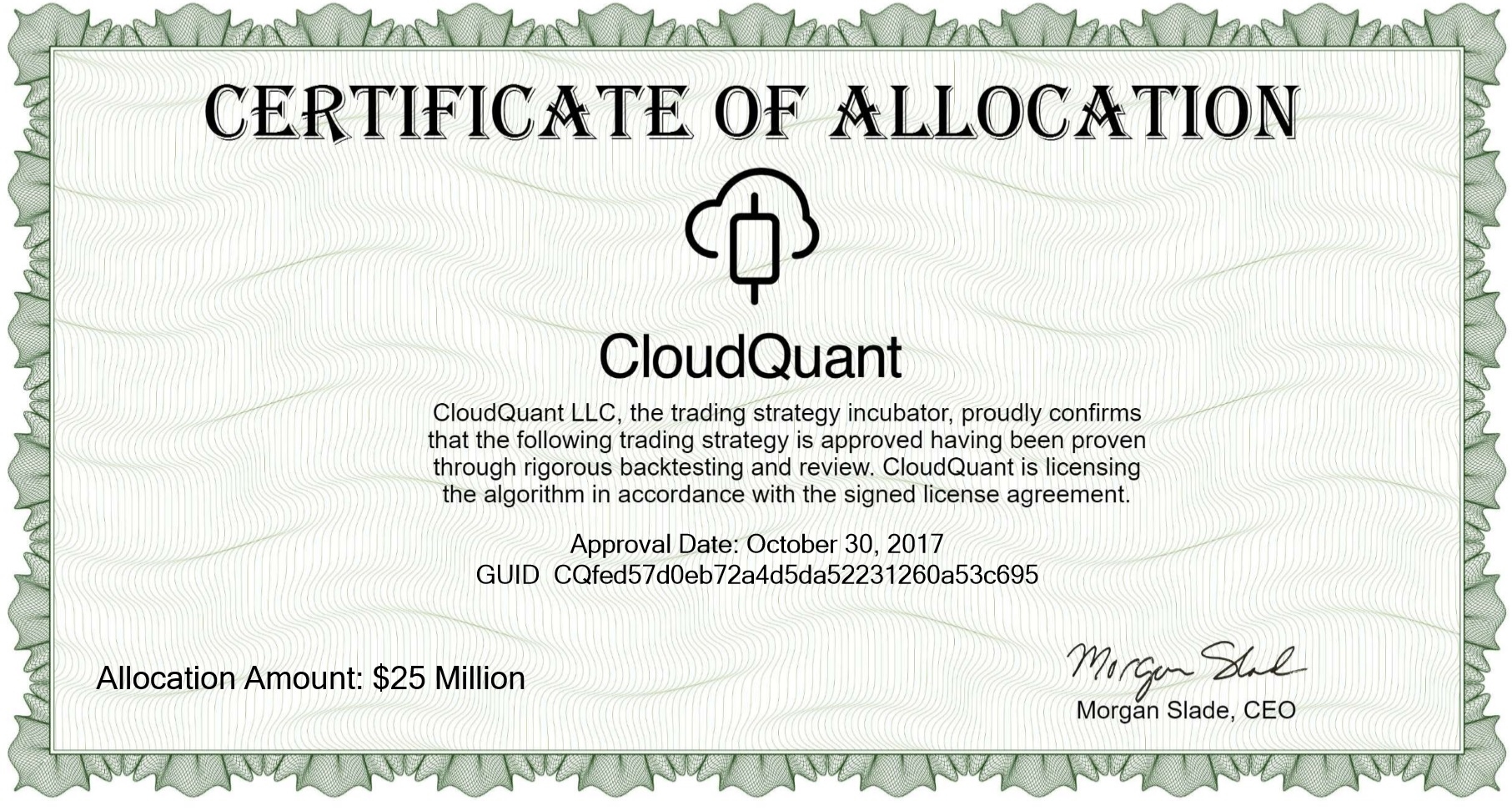

Today we announce the awarding of another allocation taking our total to $72Million USD in awarded allocation certificates.

https://info.cloudquant.com/allocations/

Tagged:

Comments

Congrats guys. Good to know. Is there a way you can provide a brief description of the types of strategies funded? Example, the second funding was for an ETF type of strategy that was scalable. I started focusing on ETFs to get more up to speed. If strategy 3,4,5 were also ETF ones, then it would be good to know and then I can focus completely on it. Also, would it be possible to state if the people getting allocation are from the industry or not? This will then help with motivation especially if people outside the industry are getting funded. Thanks.

Hi,

I am the person who got the first allocation. I work at a university in the UK and I am a CFA charterholder.

I write long/short equity strategies, but previous to CloudQuant I had written CTA-style futures strategies.

Obviously we would not want to disclose the models that we are funding, we respect our model owners IP but I would say that, if models 3,4 and 5 were ETF based then we would be more likely to fund a non-ETF model that another model in the same silo.

The model requirements are fairly simple, Smooth equity curve, reasonable sharpe and drawdown stats and scaleable. If you find alpha, it is genuine, consistent and scaleable then we are interested. We are running a number of models live, none of them are the same, diversity of type is the goal.