CloudQuant API vs. Quantopian API

ms778834

Posts: 28

ms778834

Posts: 28

Hey fellow quants!

Is there anyone who ported their algorithm(s) from Zipline/Quantopian? I would love to have a comparison of both APIs, as the CloudQuant's one is very different and the documentation here is quite poor - isn't there a one-to-one compilation of API calls from both platforms?

Does CQ have an equivalent of Zipline's context for the global variables?

My next question is related to portfolio rebalancing: how to do that? I need to use an equivalent of order_target_percent, but position_size only sets absolute number of shares, not the relative one, i.e. the percentage of portfolio's value to be allocated in a particular stock.

BTW, forum.cloudquant.com server's time is 13 minutes delayed; also, many of the Public Scripts do not load (College_Challenge, for example). And one cannot delete all backtest results at once ('DELETE ALL' does not work)! :-/

Comments

Martin -

Thanks for the feedback

Hi Martin,

I believe the following two examples would probably realize the functionality of global variable: context in zipline:

The example above would let you query market data of other symbols within an instance, which is very useful for pairs-trading-like strategies.

The second example illustrates how you could setup general class/global variables that can be shared by all instances. You may also read your user files in on_strategy_start to do so, e.g.

cls.shared_data = service.read_file(my_user_file_name). The class variable in class methods could be reached via:cls.shared_datawhile in other object level methods via:self.__class__.shared_data.Hope that helps you to build the strategy!

Shayne, all of the Public Scripts seem to load now, including the College_Challenge. Previously, I was getting an error message which read "Could not fetch data for publicuser!", or something similar.

Concerning the documentation, it is well categorised, nevertheless, what I am missing is more top-down approach→ with Quantopian, one can use some neat one-liners to express what he wants; CQ is much more complex. I appreciate the freedom it gives me, but my algorithm is not an HFT one, and I have yet a lot to learn, being only 21 yo. For example, working with and retrieving data and/or placing orders is much easier in Quantopian, or at least it seems to me like that. Maybe it is just that I am not used to CQ yet.

John, thank you for the code; unfortunately, I can't tell you how much it has helped me, as I am waiting for statsmodels to be installed to be able to run my script.

Anyway, when statsmodels is up and running, would any of you guys have time to help me implement parts which I might have trouble with? I assume both of you work for KTG, so we could just connect on Skype and share screens ;-)

My algo's got 4.6 Sharpe, 8.56 Sortino and 23% p.a. with only 1.98% DD, and β .019 over a 4-month $30M paper trading period.

Hi Martin,

We are in the process up upgrading our user onboarding and educational content that will give you a more top-down approach to learning. We appreciate you feedback and patience.

statsmodel is now installed as requested.

As a fellow developer we value your input and are working to fill in the gaps you have pointed to. Keep the ideas coming.

Quantopian is a contest and they completely changed their documentation at one point and it seemed confusing. Also you can only enter when the contest starts to be counted. Not that contest are bad but it would be nice to have a contest against yourself without some specific date.

Tradertb123 Well, APIs change, even here. And contests are great, especially if you are the winner!

Now I would like to know an optimal way to make my algorithm order shares according to the amounts specified in such pandas DataFrame ↓

The sign specifies direction (minus →order.algo_sell(), plus →order.algo_buy()). With Quantopian, Zipline converts that for you; CloudQuant, on the other hand, takes an absolute value, soposition_size= -2998420automatically becomesposition_size=2998420, same withorder_quantity. Isn't there something likeorder.determine_direction()?And my 2nd question is: why is there the

intentparameter, and can I omit it in live trading?Intent = a rational check to ensure that the algo is either increasing or decreasing or exiting or entering. It serves as a safety check on the algo.

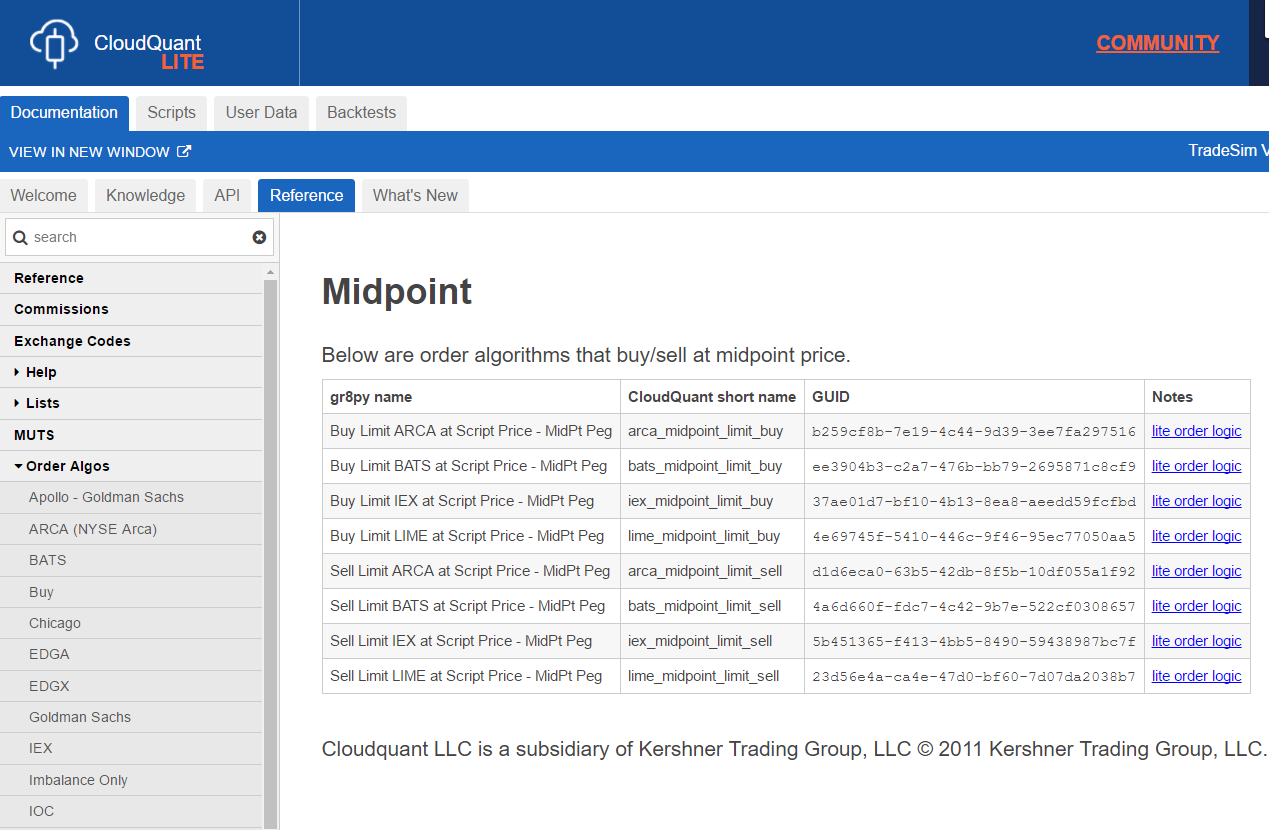

As for the optimal way to buy or sell.... that somewhat depends upon your strategy. Some strategies are OK with a market algo_buy or algo_sell. Other strategies want to use limit orders. In the documentation under "Reference" you will find a number of "Order Algos".

These are useful for entering larger positions like what you are showing in your question. Maybe a TWAP or VWAP, or MidPoint algo would be best. BUT it all depends upon your strategy. Many people will do a data study around how the different algo_buy() algorithms perform to choose the optimal one for their strategy.

As for auto determination based only on quantity, could you consider writing your own function that would handle this for you? It would only be a few lines of code!

@jd623170 Actually, I have already figured out what order algorithm to use to minimise market impact, after all, figures in the DataFrame above are larger than what I will actually be ordering, just to test the market. By optimal I meant requiring as short computing time as possible.

By optimal I meant requiring as short computing time as possible.

As for writing my own function... I could theoretically write the whole backtester, but isn't a point of CloudQuant to let you do as much as possible as fast as possible? Moreover, I don't have access to any CloudQuant's source code files, because, unlike its competitors, Kershner Trading Group has not open-sourced anything yet! This means that I can only code in Python→ my code gets interpreted by IronPython (or maybe CQ already uses CPython), which is gonna be significantly slower that having a function in the C++ & Cython kernel whose output would be in FIX and/or exchange-native protocol, routed directly to them exchanges and liquidity pools.

This means that I can only code in Python→ my code gets interpreted by IronPython (or maybe CQ already uses CPython), which is gonna be significantly slower that having a function in the C++ & Cython kernel whose output would be in FIX and/or exchange-native protocol, routed directly to them exchanges and liquidity pools.

@ms778834 Hi Marin, as for the intent parameter, I think you can set it to be 'none' to skip the rational check; however, for some strategies, it might be useful to utilize this feature and make sure the order logic is correct. As for the direction of sending orders, we appreciate your advice and we would consider incorporating this for better user experiences. The current algo_buy and algo_short, however, gives you some more choices over the type of execution such as VWAP, midpoint peg orders, etc; you can apply different GUIDs or shorthands according to the doc on the documentation website and we do provide several different sources of brokerage for comparison. We hope that would bring more practical trading experiences to the user including other features for example: if you are providing liquidity, we also calculate the rebate/commission credit to your account. There is no doubt that a C++/Cython based kernel would be faster, but CloudQuant is utilizing the cloud to perform the computations in a distributed way, which is another form of efficiency enhancement. On the other hand, we do have our simulation report open sourced and a couple of more projects are going to be open sourced later this year. By open sourcing the codes, we believe experienced professionals like you would definitely come up with more valuable suggestions to us and make us better.

You are right about the reports, @johnbear565 , I forgot them. And I am glad about that, as well as about your open source initiatives continuing!

What I am now aiming for is to find the most efficient way to execute trades according to my DataFrame above, preferably without losing my "for loops virginity" I've managed to keep so far in my script. Not only does it require +/- splitting to

order.algo_buyandorder.algo_sell, respectively, but also passing varying amounts ontoorder_quantity, as this parameter does not accept pandas objects.